In the world of business operations, comprehending and efficiently handling USA sales taxes is paramount. Navigating the intricate web of regulations governing USA sales taxes can be daunting. However, armed with the appropriate knowledge and strategies, businesses can maximize tax savings while adhering to legal requirements. The management of USA sales taxes involves various practices aimed at navigating the complex tax laws governing the sale of goods and services in the United States. From grasping fundamental concepts to implementing strategies for tax optimization, businesses must prioritize compliance and efficiency in their approach to USA sales taxes.

The Importance of Complying with Sales Tax Laws

Complying with sales tax regulations is not just a legal necessity; it also significantly impacts a business’s financial health and reputation. Failure to comply can lead to severe penalties, audits, and even legal repercussions, which can negatively affect a company’s bottom line and reputation.

Grasping the Basics of Sales Tax

Sales tax is a consumption tax imposed on the sale of goods and certain services at the point of purchase. Unlike income tax, which is based on a taxpayer’s earnings, sales tax is imposed on the buyer and collected by the seller, who then remits it to the appropriate taxing authority.

Nexus: A Critical Factor

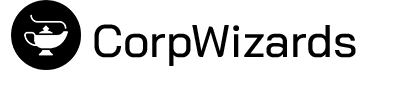

Nexus refers to the sufficient physical or economic presence of a business in a state that triggers the obligation to collect and remit sales tax. Nexus can be established through various factors, including:

- Physical presence such as offices, stores, or warehouses

- Economic presence through online sales or affiliate relationships

- Temporary presence through trade shows or sales representatives

Strategies for Maximizing Tax Savings

While sales tax compliance is non-negotiable, there are legitimate strategies that businesses can utilize to maximize their tax savings within the confines of the law..

Understanding the Taxability of Goods and Services

Understanding the taxability of specific goods and services is crucial for minimizing tax exposure. Certain items may be exempt from sales tax or subject to reduced rates, depending on the jurisdiction and applicable regulations. Conducting thorough research or consulting with tax professionals can help businesses identify opportunities for tax savings.

Embracing Automation and Technology Solutions

Embracing automation and leveraging technology solutions can streamline sales tax compliance processes and minimize the risk of errors. Automated tax calculation software can accurately determine applicable tax rates based on transaction details, reducing manual effort and ensuring compliance across multiple jurisdictions.

In Conclusion

In conclusion, navigating the complexities of USA sales taxes requires a combination of knowledge, diligence, and strategic planning. By understanding the fundamental concepts of sales tax, implementing proactive compliance measures, and leveraging available strategies and technologies, businesses can optimize their tax savings while maintaining compliance with legal requirements. Embracing a proactive approach to sales tax management not only minimizes financial risks but also fosters long-term sustainability and growth for businesses operating in the United States.

Resources and Further Reading:

- IRS Sales Tax Information: Explore detailed guidelines and resources directly from the Internal Revenue Service (IRS) on sales tax regulations in the United States. IRS Sales Tax Information

- State Department of Revenue Websites: Access state-specific information and regulations regarding sales tax compliance through respective State Department of Revenue websites. Find your state’s specific requirements and guidelines.

- TaxJar: Discover how TaxJar’s sales tax automation platform can simplify your tax compliance processes. Automate tax calculations, filing, and reporting across multiple jurisdictions. TaxJar

These resources offer valuable information and tools to help businesses navigate the complexities of sales tax management in the United States. Whether you’re seeking authoritative guidance, automation solutions, or legal insights, these resources can aid in optimizing your tax compliance strategies.

FAQ

Sales tax is a consumption tax imposed on the sale of goods and certain services at the point of purchase. Unlike income tax, which is based on a taxpayer’s earnings, sales tax is imposed on the buyer and collected by the seller, who then remits it to the appropriate taxing authority.

Nexus, or the sufficient physical or economic presence of a business in a state, triggers the obligation to collect and remit sales tax. Nexus can be established through various factors, including physical presence such as offices or warehouses, economic presence through online sales, or temporary presence through trade shows.

Businesses can optimize their tax savings by understanding the taxability of goods and services, leveraging available exemptions and reduced rates, embracing automation and technology solutions for streamlined compliance processes, and staying informed about changes in sales tax regulations.

Non-compliance with sales tax laws can lead to severe penalties, audits, legal repercussions, and damage to a business’s financial health and reputation. It’s essential for businesses to prioritize compliance to avoid these risks and ensure long-term sustainability and growth.

For businesses seeking comprehensive support in navigating the intricacies of sales tax compliance, CorpWizards offers tailored solutions and expert guidance. Their suite of services includes sales tax consulting, audit assistance, and compliance management tools. With a focus on efficiency and accuracy, CorpWizards empowers businesses to stay compliant while focusing on their core operations and growth strategies. Explore CorpWizards‘ resources and solutions to enhance your sales tax management efforts and ensure long-term financial health.